GSave: Simplifying High-Interest Savings Accounts for You

Over the years, money stuff in the Philippines has changed a lot. Now, it’s easier for people to use services like GSave to save money. Lots of people are using less cash and doing more shopping and money stuff on their phones.

Using GCash and similar apps helps people do money stuff and reduces the chance of someone stealing their money. With more and more apps for banks and money things, it makes sense that these services will keep getting better.

You can pay your bills, send money, and take care of money stuff online.

GSave is a savings account that helps you make more money without any trouble. It’s like teamwork between GCash and CIMB Bank, which are two good money companies in the Philippines. In this guide, we’ll talk about what can do, how it works, and why you might want to get an account.

Read this: How To Convert Globe Load To GCash

What is GSave?

GSave is like a piggy bank on your phone where you can keep your money safe and also make some extra money. You can get a savings account from different banks like CIMB, BPI, Maybank, and UNO Digital Bank.

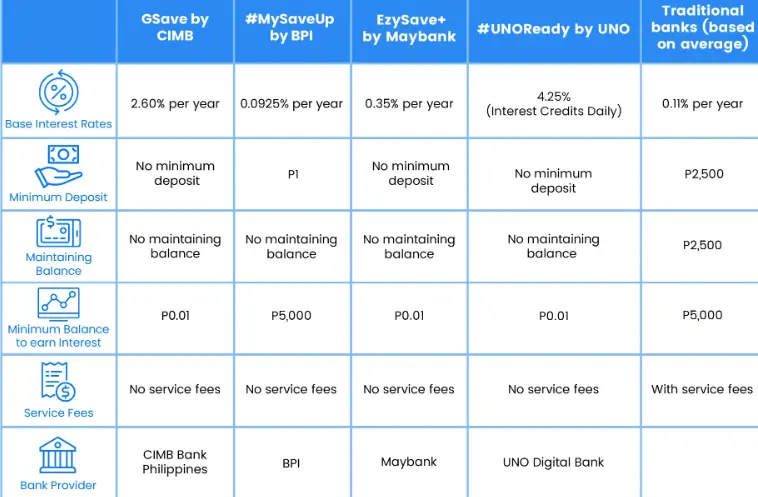

Let’s check out how GSave from CIMB is different from #MySaveUp by BPI, EzySave+ by Maybank, and #UNOReady@GCash by UNO Digital Bank and other regular banks in the Philippines.

GSave Kickoff: Getting Started Made Simple!

Starting with GSave is simple. Get the GCash app, sign up for an account, and make your GSave account active in the app. After that, you can put money into your GSave account using your GCash wallet or a bank account connected to it.

Applying for GSave: A Simple Guide

If you have everything you need, like being a verified GCash user, joining GSave is fast and simple. Let’s go through the steps to begin!

Read this: How to Load Cignal Using GCash 2024

Log into your fully verified GCash account

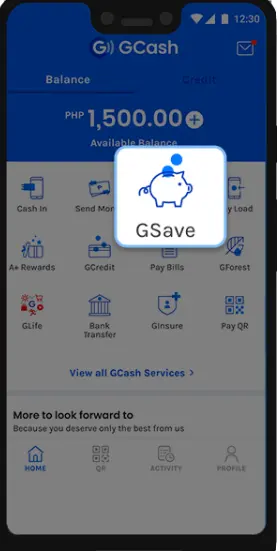

Check out the main screen of GCash and look for the GSave picture. Click on it, and it will lead you to a new page where you can make a new savings account.

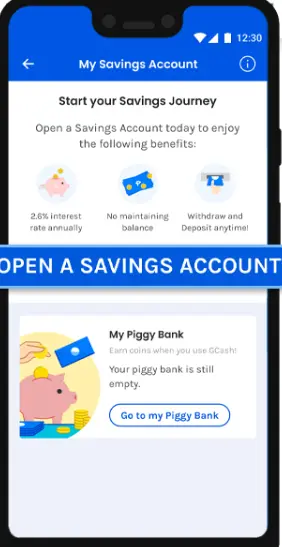

Click on “Open a new savings account.”

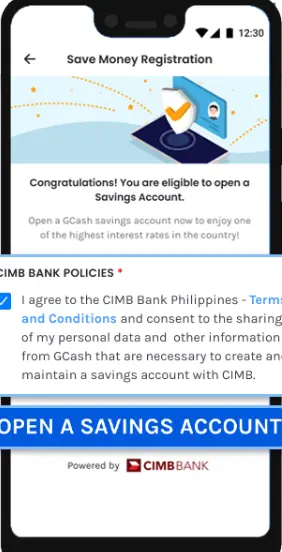

You’ll go to a webpage where you can make a savings account by clicking the “Create a savings account” button. Read the rules.

When you get what it’s all about, say you’re okay with the rules and wait for a text from CIMB Bank on your GCash number. Fill out the form, and you’re good to go!

Sign up for an upgrade

GSave has some rules, but if you want more good stuff, you can make your account better anytime for free. There’s a limit to how much money you can put in (up to $50,000), and your account can only be open for a year. Make the most of the app by improving your savings account!

When you upgrade, you’ll go to a page where you put in your information.

Read this: How to Pasaload in Smart

Enjoying the Benefits and Advantages

- Get more interest on your money! UNO and CIMB, our digital bank buddies, offer interest rates of up to 4.25% and 2.6% per year. UNO even gives you up to 6.5% if you put your money in time deposits. These rates are better than what regular banks offer.

- Anyone can start saving, even if they don’t have a lot of money. Most GSave pals don’t ask for any money upfront, and you don’t need to keep a small amount or balance.

- Open a bank account that’s always ready. There is no need to take a break from work to open or manage your account. Even better, you can do everything online without leaving your home!

- Keep your savings separate. It’s easier to handle money when it’s not all in one place. With GSave, you can move the money you want to save from your regular bank to GCash and hit the “Save Money” button.

- GSave makes saving a habit. There is no need for a large starting amount. You can start with 10–20% or even a little bit regularly. Every month or payday, move a fixed amount or percentage to your account and see your money grow.

GSave Duration: Is There an Expiry Date?

There are some extra rules for regular GSave accounts, on top of what we already talked about. The Bangko Sentral ng Pilipinas made these rules because you don’t need to meet face-to-face:

- Your account works for only 12 months from when you sign up.

- You can only put up to $50,000 in total in your account.

- GSave Plus will tell you when you’re getting close to these limits.

If you don’t put money in your GSave within a year or don’t make it better within a year, your account will stop working.

GSave Transactions: Easy Steps to Deposit and Withdraw

Here are the two steps to help you put money into your GSave account:

Step 1: Open your GCash app and tap Save Money from the main screen. After that, click on the deposit option.

Step 2: Choose how much money you want to put in from what you have. Double-check and make sure the transaction is confirmed.

Here are two simple steps to take money out of your GSave account:

Step 1: Start your GCash app and tap on Save Money. Then, choose the withdrawal option and tap on it.

Step 2: Type in how much money you want to take out and press confirm to finish.

GSave Withdrawal Guidelines: Understanding the Policy

Yes, you can take out all your money whenever you want. Move the money back to your GCash or a bank connected to it. But remember, when you take out your money, you might lose a bit of the extra money you earned.

Read this: How to Pass a Load in Globe

Connecting GSave to CIMB Bank PH App: A Simple Guide

Step 1: Get the CIMB Bank app from Google Play or the Apple Store. Open it and tap on “Link my GSave account” on the login page.

Step 2: Use the temporary login details sent through SMS. Your username is your phone number starting with 9, and the password is given by the system.

Step 3: Make a username and password you like, then fill in the details. Check your email for the verification link.

Do you have more questions about GSave? No problem! You can find all the information you need in GCash’s Help Center.

FAQs

How Do You Earn 4% Interest on Gsave?

Put any amount of money into your GSave account, and you’ll earn 4% interest. They count the interest every day and add it to your account every month. The interest rate is always 4% each year, so you know you’re getting a good deal for your money.

Is Gsave free?

Yes! Making and keeping a GSave account doesn’t cost anything. There are no secret fees or extra charges, so you can save your money without worrying about paying more.

Is Gsave a bank account?

GSave is not like a regular bank account, but it’s a team-up between GCash and CIMB Bank. The money in your account is kept safe with CIMB Bank, and it’s insured by the Philippine Deposit Insurance Corporation (PDIC) for up to PHP 500,000. So, your savings are protected and secure.

How much can I withdraw from Gsave?

You can take out as much money as you want from GSave. Whenever you need to, you can withdraw all or just a part of your savings.

Why can’t I withdraw from Gsave?

If you can’t take money out of your GSave, there might be a problem with your GCash or connected bank account. Reach out to GCash customer support for help.

What happens if my GSave account expires?

Your account won’t go away, but if you don’t use it for a whole year, it becomes inactive. To bring it back to life, just put in or take out some money.

Read this: How to Pay Police Clearance via GCash

Conclusion

Many people can do transactions using apps and online wallets. Paying bills and sending money is super simple with trusted services like GCash.

Get the GCash app and make a GCash Savings Account now to enjoy all the perks of online banking! It only takes a few seconds!

- GCash Indonesia: Easy and Safe Online Transactions - June 13, 2024

- Contact GCash Hotline for Immediate Assistance - June 13, 2024

- GCash Cash-in Fee at 7-11: Quick & Easy Transactions - June 12, 2024