How to Activate and Use GGives in GCash

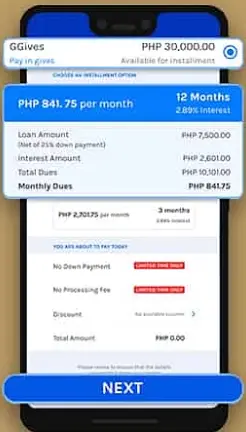

GCash now has a new thing called GGives. It helps Filipinos buy things without paying for them all at once. You can pay for stuff up to Php30,000 in total over 12 months. This means you can split the cost into smaller payments, called “gives,” which can go up to 24 times.

You can choose to pay back what you owe in 3 or 6 months. That makes it easier for you to manage your money.

The cool thing is that you might not have to pay any extra money for borrowing. That’s because sometimes there’s 0% interest. For example, if you borrow Php30,000 and pay it back over a year, you might pay around Php3,400 each month. Just remember, the exact amount might change depending on how long you take to pay and your GScore. In this article, we discuss how to activate and use GGives in GCash.

What’s the Difference Between GGives and GCredit?

GGives and GCredit are like money helpers for people who use GCash. But they work a bit differently.

GGives is made by Fuse Lending, Inc., which is owned by the same company that runs GCash, called Mynt. On the other hand, GCredit is linked with CIMB Bank, a big bank from Malaysia. Both GGives and GCredit follow rules from a group called the Securities and Exchange Commission (SEC) to make sure everything’s fair.

Right now, GGives lets you borrow money only when you pay at certain shops using a QR code. But GCredit lets you borrow for online shopping and also when you scan a QR code at stores.

It seems like GGives might give you more money to borrow compared to GCredit if you have the same GScore. For example, someone with a score of 515 could borrow up to ₱6,000 with GGives but only ₱1,000 with GCredit.

Who is qualified for GGives?

To use GGives, you need to make sure you meet these rules:

- 1. You have to finish verifying your GCash account.

- 2. You need to be a Filipino, between 21 and 65 years old.

- 3. Your GScore should be good.

- 4. You should have a good record for paying back money, and you shouldn’t have done anything wrong, like cheating in transactions.

How to activate GCash GGives

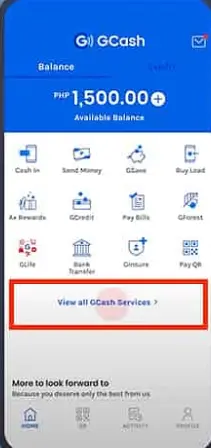

1: Open the GCash app and click on “View all GCash Services.“

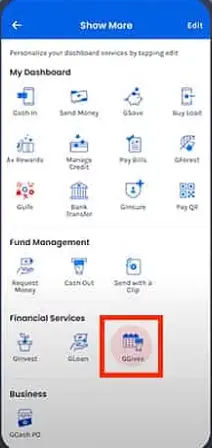

2: Click on “GGives” in the ‘Financial Services’ part.

3: Inside GGives, check and make sure all your information is correct. If you couldn’t get to this part or got an error, look below to find out why it might have happened.

How to use GCash and GGives

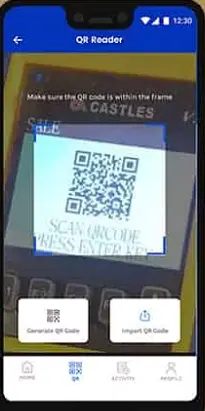

1: Go to the GCash app and click on “QR” from the main screen.

2: Use your phone to take a picture of the special code at the shop or store.

3: Type in the money amount and then click “Next.”

4: Pick GGives when you see payment choices and choose how you want to pay back your money in parts.

5: Look over all the details, agree by saying yes to the Disclosure Statement, and finally, tap “Pay PhpXXX” to finish.

FAQs

Why are GGives not available for me?

GGives is for some GCash users, not everyone. You can check if you meet the rules to join. If you can’t join, maybe your GScore isn’t high enough yet.

Can I pay online using GGives?

With GGives, you pay at a shop by scanning their code with your phone. You can also pay online by scanning the code on your computer or another phone.

Can I avail of two or more GGives at one time?

No, you can only have one loan at a time. You need to finish paying back your current loan before getting another one.

How do I pay my loan?

To pay what you owe for your loan, like the money you borrowed plus any extra fees, go to the GGives part of the GCash app. Click on “View all GCash Services,” then pick “GGives.”

Will I get cashback if I pay my dues early?

Yes, if you finish paying back all your loan money before the end date, you’ll get some cash back. The cashback will be the interest money you would have paid for the months left on your loan.

Can I use GGives to pay my bills?

No, you can’t pay your bills with GGives. But you can use GCredit in the GCash app to pay your bills.

Conclusion

In conclusion, starting and using GGives on GCash isn’t just about transactions. It’s a way to make a good difference and feel more in control of your money. GG gives you part of your regular money on how to activate and use GGives in GCash, changing how we see online money. Begin your GGives journey now and feel the happiness of giving with GCash.

- GCash Indonesia: Easy and Safe Online Transactions - June 13, 2024

- Contact GCash Hotline for Immediate Assistance - June 13, 2024

- GCash Cash-in Fee at 7-11: Quick & Easy Transactions - June 12, 2024